Best Tips To Selecting Maple Leaf Gold Bars

Wiki Article

What Should I Think About When Purchasing Gold Coins Or Bullion From Czech Republic?

Take note of these things when deciding whether to invest in bullion or gold coins in Czech Republic: Reliable sourcePurchase gold coins from reliable sources. Accredited dealers and institutions assure authenticity and quality.

Weight and purity- Check both the purity and weight of the gold. Gold bullion comes in various weights and purity levels (e.g. 22, 24 etc.). Ensure it meets requirements of the standard.

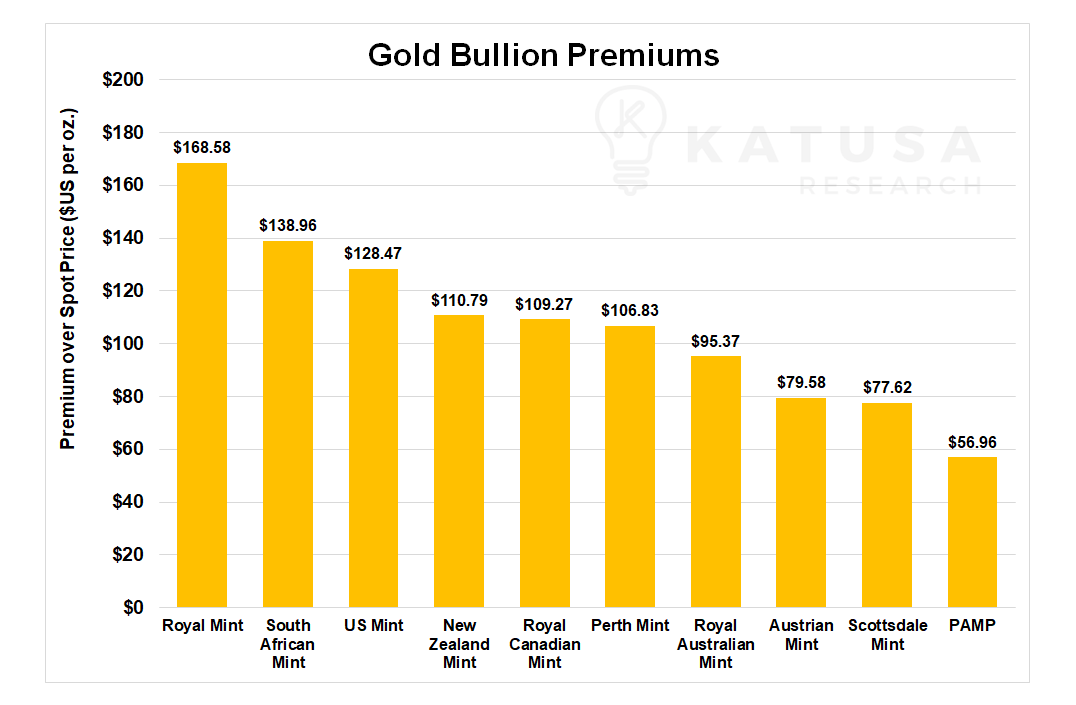

Understanding the Pricing Structure- This includes the spot price of gold and any additional charges imposed by Dealers. Compare prices from different sellers to get the best return on your investment.

Storage and Security - Think about safe and secure options to store your precious metals. Security concerns are one reason why many investors opt to store their gold in the bank.

Liquidity, and Selling Options- Think about how easy it is to sell your assets when you need to. Choose bullion or coins with large liquidity that can be traded on the market. Have a look at the most popular Prague Gold info for blog recommendations including cheerios sacagawea dollar, ancient coin, st gaudens double eagle, gold 1 dollar coin, gold and coin shops near me, sovereign british coin, jm bullion gold price, canadian gold maple leaf, gold coins for sale, 50 pesos gold coin and more.

How Do I Ensure That The Gold Coin I Purchase Is Of Good Quality? Or Bullion That I Purchase From Czech Republic?

Verifying the authenticity and documentation of gold bullion as well as coins in the Czech Republic includes several steps.-

Hallmarks and Certifications- Look for hallmarks or stamps that are recognized on gold-based items. These hallmarks show the purity, weight and authenticity of the gold and are typically provided by reputable assay offices, or by government institutions. Purity Verification - Check for hallmarks that indicate the level of fineness or karatage in order to prove the purity of the gold. A 24-karat piece of gold is considered to be pure. Lower levels of karatages indicate the different levels or alloys.

Trustworthy sellers- Purchase gold from only dealers that are trustworthy, established, and authorized. They usually provide authentic certificates of authenticity as well as receipts with the specifications for gold.

Ask for Documentation - Request certificates of authenticity or assay certificates accompanying the gold purchase. These documents should contain information about the purity of the gold weight, weight and manufacturer and hallmark.

Independent Verification: Consider getting an independent appraisal or verification by a third-party expert appraiser. They will verify the authenticity of gold as well as provide an unbiased evaluation of its value.

The process of confirming authenticity requires doing the necessary research. Affirming the credibility of your supplier and having the appropriate documentation is essential to ensure you're purchasing authentic, top-quality bullion. Follow the top article source for Gold Bohemia for website recommendations including spanish gold coins, gold and coin near me, 1 0z gold, angel coin, five dollar gold coin, 2000 sacagawea dollar, gold one dollar coin, gold quarter, $5 gold piece, five dollar gold piece and more.

What Is A Tiny Increase In The Price Of Stocks And A Small Price Spread Of Gold?

In the world of gold trading Low price markup and spread refer to the expenses involved in purchasing or selling gold when compared to market prices. These terms describe the amount you'll pay for gold, whether it's as an increase or spread. A low markup implies that the dealer is charging just a slight cost over market value. Low markup signifies that the cost of gold you pay is near or barely higher than its current market value.

Low Spread Price- The spread is the price difference between asking and buying price of gold. A low price spread signifies a smaller difference between these prices, meaning there's less an in-between between the price at which you can purchase gold and the cost at which you sell it.

What Are The Mark-Ups And Price Spreads Differ Between Different Gold Dealers.

Negotiability- Some dealers might be more open to negotiation regarding mark-ups and spreads especially for larger transactions or returning customers. Geographical Location: Mark-ups and spreads can vary depending on the regional conditions, local regulations, and taxes. For example, dealers who are located in areas that have higher taxes or regulatory costs could pass those expenses to customers through greater mark-ups.

Product Types and Availability: Markups and spreads can vary based on product type (coins/bars/collectibles) and the availability of the item. Due to their rarity rare and collectible items may have higher markups.

Market Conditions- During periods of increased demand, scarcity, or increased market volatility, dealers could expand their spreads to lessen the risk or to cover losses.

Due to these factors that gold buyers should conduct extensive study and compare prices between several dealers. They should also consider other factors than margins and markups, such as reliability, customer service, and reputation when choosing dealers. Looking around and obtaining quotes from different sources can help determine competitive prices for gold purchases. View the top rated sell on Gold Charles III for website advice including ira investing gold, saint gaudens double eagle, investing in gold, gld etf, 10 dollar gold coin, gold coins for sale, cost of 1 oz of gold, gold buffalo coin, george washington gold dollar, silver stocks price and more.